In 2025, Sweden won the EU “FDI league” yet again, but is it the right game to win?

1. ISP’s 2025 in review

If sheer volume of FDI notifications reviewed were a European championship, Sweden would likely win by a comfortable margin. However, quality, and not quantity, is often the best measure of success.

The Swedish FDI authority, the Inspectorate of Strategic Products, or ISP, published its 2025 statistics yesterday (15 January). The figures show a record 1987 filings reviewed during the year. This represents an increase of 58 per cent compared with 2024, when the authority received 1261 notifications.

Only 20 cases progressed to an in-depth review, amounting to just 1 per cent of all filings. Out of these 20, one transaction was approved subject to conditions and two transactions were blocked. The ISP has not publicly identified the parties involved or the sectors concerned.

The data also indicate that out of the 20 in-depth cases, 4 filings were voluntarily withdrawn after the ISP informed the parties of its preliminary assessment. This may imply a larger number of transactions raising serious concerns; for some parties, stepping back may have been preferable to inviting an adverse ruling or unwanted publicity.

2. Sector focus

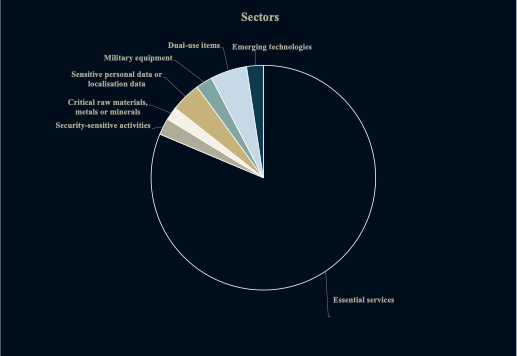

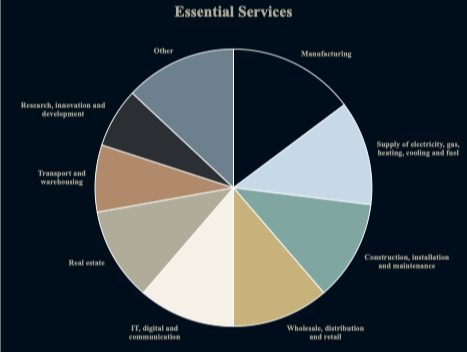

The ISP also provides some interesting data on its sector focus. It is not surprising that “essential services” makes up the majority of the incoming notifications, given the very broad scope of the category.

3. Comparison with other countries

The volume of filings reviewed in Sweden during 2025 is striking, especially when compared to other European countries.

While 2025 data is not yet publicly available across Europe, several authorities have published statistics for 2024. These figures offer a useful benchmark against which to assess Sweden’s position.

It is notable that Germany, the United Kingdom and France, with economies five to seven times larger than that of Sweden, review fewer notifications. While many factors influence levels of foreign investment, including openness to foreign ownership, tax policy and regulatory burden, one could expect at least some correlation between the size of the economy and the number of transactions subject to screening.

The fact that Sweden screens roughly twice as many transactions as Germany and France combined invites the question whether Sweden’s regime casts too wide a net.

Interestingly, the UK government has said it intends to reduce unnecessary red tape for businesses by narrowing the scope of its FDI regime. One measure under consideration is the removal of the filing requirement for internal restructurings.

4. EU-level reforms

Meanwhile at EU level, the Council and the Parliament reached a provisional political agreement in December 2025 on revisions to the FDI Screening Regulation. This follows the Commission’s proposal for a revised regulation presented in January 2025.

Under the revised framework, screening and decision-making powers remain at national level. Yet, the regulation does seek to harmonise certain national rules and facilitate cooperation between Member States.

The FDI Screening Regulation continues to set a minimum scope, leaving Member States free to operate broader regimes. While the final text is yet to be published, it appears that most, if not all, of the sensitive areas identified at EU level are already covered by the Swedish legislation. On that basis, the revised regulation is unlikely to require a fundamental overhaul of Sweden’s regime.

That being said, Sweden could use the implementation process as an opportunity to recalibrate its rules and bring them more in line with those of other Member States. Targeted adjustments of this kind could materially reduce the volume of filings, without necessarily weakening the protection of genuinely sensitive interests.

5. Outlook

It would seem high time for Sweden to reflect on possible reforms to its FDI regime. Processing close to two thousand notifications in a single year is resource intensive and risks drawing attention and resources away from transactions that genuinely warrant scrutiny.

The resources spent on reviewing thousands of notifications might be more effectively deployed in a unit tasked with proactively identifying unnotified transactions that merit intervention, or in strengthening case teams dealing with security sensitive deals. Sweden’s very low intervention rate suggests that the focus should shift from quantity to quality. At least two immediate potential amendments come to mind:

First, the filing requirement could be removed for internal restructurings where ultimate ownership remains unchanged.

Second, Sweden could reconsider the obligation for EU based investors to file. A filing requirement could remain where an EU based investor is ultimately controlled by a parent company based outside the EU.

_________________________________________________

[1] Inspectorate of Strategic Products, Statistics Q4 2025, published 15 January 2025, available at: https://isp.se/media/2g2hxnfi/statistik-2025-kv4.pdf

[2] Inspectorate of Strategic Products, Statistics 2024, available at: https://isp.se/media/2g2hxnfi/statistik-2025-kv4.pdf

[3] Bundesministerium für Wirtschaft und Klimaschutz, Investment Screening in Germany: Facts & Figures, all figures as of 31 January 2025.

[4] Numbers as of 31 January 2025. As of that date there were 19 cases filed in 2024 and one case filed in 2023 that were not yet closed. Therefore, this number may ultimately been higher.

[5] UK Government, National Security and Investment Act 2021: Annual Report 2024–25, published 22 July 2025.

[6]Ministère de l’Économie, des Finances et de la Souveraineté industrielle et numérique, Contrôle des investissements étrangers en France, Rapport annuel 2025.

[7] UK Government press release, “National security powers to be updated to reduce the burden on businesses”, 22 July 2025, available at: https://www.gov.uk/government/news/national-security-powers-to-be-updated-to-reduce-the-burden-on-businesses.